EZ Pre-Certification and Certification Applications

Application Process

Step 1: Pre-Certify

Annual Pre-Certification is required for each business location before beginning eligible investments or activities.

Step 2: Certify

Certification is completed at the end of the tax year to earn tax credits for eligible activities performed during the Pre-Certification period.

Step 3: Submit

Tax credits are claimed by filing the approved EZ Certification with the business’ Colorado state income tax return (as applicable).

Need to confirm your address first?

Use the mapping tools to confirm the business location is inside the Zone boundary.

OEDIT Enterprise Zone Program PageEnterprise Zone (EZ) Pre-Certification Application

Pre-Certification is a quick online process that confirms your business location is eligible to earn and claim Enterprise Zone tax credits for a specific tax year.

When to Pre-Certify

- Up to 90 days before the start of your business’ tax year.

- Any time during your tax year; however, credits generally can only be earned from the date of approval forward (not retroactively for periods before Pre-Certification).

- Each tax year you want to claim credits, you should complete Pre-Certification for each business location.

How to Apply

- Visit the Colorado Office of Economic Development & International Trade (OEDIT) Enterprise Zone program page.

- Select the option to apply for a tax credit to begin the Pre-Certification process.

- Your application is reviewed by the local Enterprise Zone Administrator.

- Keep the approval email/confirmation for your records.

Enterprise Zone (EZ) Certification Application

After your business tax year ends—and before you file your Colorado return—you complete the EZ Certification to document the eligible activities and generate the certification you’ll use for the tax filing.

When to Certify

- After your tax year ends and before submitting your Colorado state income tax return.

- Important: You must already have an approved Pre-Certification for the same tax year to complete Certification for most business credits.

How to Apply

- Return to the OEDIT Enterprise Zone program page and select apply for a tax credit.

- Start the Certification workflow for the applicable tax year.

- Have your EZ Pre-Certification number available when completing the Certification.

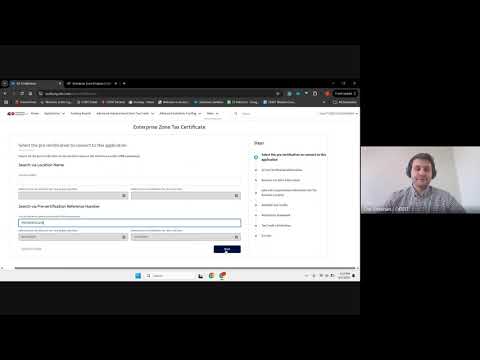

EZ Application Tutorial

Watch this walkthrough for step-by-step guidance on completing Enterprise Zone Pre-Certification and year-end Certification.

Watch Video

Watch Video

Contact Us

Disclaimer: This page provides general information and is not tax or legal advice. Program requirements may change. Confirm current requirements with the State of Colorado and your tax advisor.